Products

Our Financial Instruments

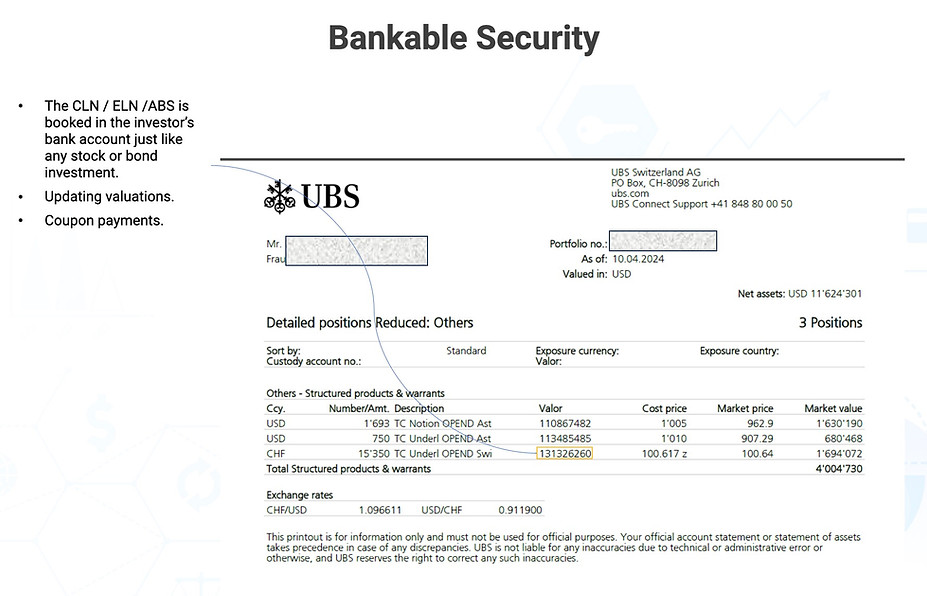

We issue bankable financial instruments with an ISIN.

Credit Linked Note (CLN)

A CLN offers yield by transferring the credit risk of a loan to investors, with returns tied to the borrower's performance.

Equity Linked Note (ELN)

An ELN transforms privately held shares into a bankable financial instrument which assists in capital raising.

Actively Managed Certificate (AMC)

An AMC enables the active trading of securities as the underlying assets of the certificate, offering an alternative to a fund setup.

Asset Backed Security (ABS)

ABS are securities backed by assets such as real estate or music royalties, offering coupon yield and appreciation potential.

Illustration of famous Zurich building. Our business has nothing to do with UBS.

Services

Advisory

-

Understanding your financing needs and collateral assets.

-

Designing the deal (e.g., loan terms, security arrangements).

-

Choosing the appropriate jurisdiction of the Issuing Entity.

Setup

-

Drafting the legal agreements with our Issuer.

-

Drafting the instrument’s Terms and Conditions (Termsheet).

-

Obtaining an ISIN for the financial instrument.

-

Creating a new sub-account with unique IBAN.

Administration

-

Net asset value and interest accrual calculations.

-

Price updates for the financial instrument.

-

Investor reporting.

-

Annual reporting.

-

Tax declarations.

Costs

-

Customized fairly to the level of complexity and intensity.

-

No hidden “bid-ask spread”, “rebalancing fee”, ...

-

Flexibility for you to charge fees however you wish.